When you’re building your nest egg, you’re focused on saving. But once you retire, the game changes. Now you need a plan for withdrawing that money—strategically. That’s where the Bucket Strategy comes in.

Let’s break it down in simple terms.

What Is the Bucket Strategy?

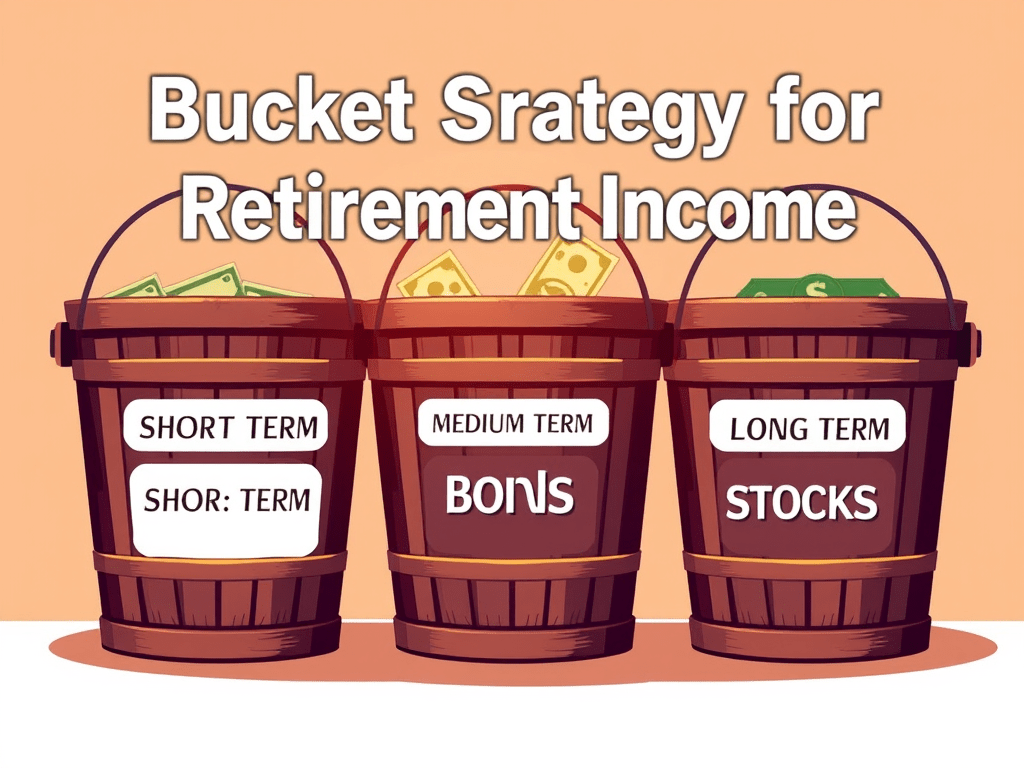

The bucket strategy is a retirement income plan that divides your assets into different “buckets” based on when you’ll need the money. Each bucket is invested differently depending on the timeline and risk tolerance.

Think of it like organizing your money into short-term, medium-term, and long-term goals.

The 3-Bucket Breakdown

Bucket 1: Short-Term (Years 1–3)

- Purpose: Daily living expenses

- Risk Level: Low

- Investments: Cash, money market accounts, high-yield savings, CDs

This is your safety net. It’s the cash you’ll live on in the early years of retirement.

Bucket 2: Medium-Term (Years 4–10)

- Purpose: Income for the mid-term future

- Risk Level: Moderate

- Investments: Bonds, bond funds, balanced funds

This bucket refills Bucket 1 as needed, while earning moderate returns.

Bucket 3: Long-Term (Years 10+)

- Purpose: Growth to outpace inflation and support later retirement years

- Risk Level: Higher (but manageable)

- Investments: Stocks, equity ETFs, real estate investment trusts (REITs)

This is where your money can continue to grow. You won’t need this right away, so you can afford to ride out market fluctuations.

How It Works Over Time

- Every year or two, you refill Bucket 1 with funds from Bucket 2.

- Rebalance Bucket 2 using growth from Bucket 3.

- This system creates a stable income while reducing the need to sell long-term investments in a down market.

Why People Love This Strategy

- Reduces panic during market drops (you won’t be forced to sell stocks)

- Provides a clear cash flow structure

- Blends safety and growth into a single plan

- Easy to visualize and manage

Potential Pitfalls to Watch For

- Requires careful rebalancing and planning

- Inflation can erode cash in Bucket 1 if it sits too long

- Needs to be customized based on personal spending and longevity

How to Start Your Own Bucket Plan

- Estimate your annual retirement spending

- Determine your “Bucket 1” size (e.g., 3 years of expenses)

- Allocate your portfolio accordingly

- Plan rebalancing rules (e.g., once a year, when gains exceed 10%, etc.)

- Consult with a financial advisor to fine-tune based on taxes, Social Security, and investment risk

The Bucket Strategy for retirement income is a powerful, easy-to-understand framework that helps you avoid emotional money decisions while providing peace of mind in retirement. If you’re nearing retirement or already retired, it might be time to set up your buckets.

Leave a comment